Navigating freelance taxes in Canada presents unique challenges and opportunities. As an independent professional, managing your taxes effectively is crucial to maximizing your take-home income and ensuring financial stability. This guide delves into comprehensive strategies to help freelancers optimize their tax filings. Understanding Freelance Taxes in Canada Navigating Your Tax Responsibilities Embarking on a freelance […]

In an increasingly interconnected world, cross-border taxation stands as a crucial consideration for individuals and businesses operating in both the United States and Canada. Navigating the intricate landscape of tax obligations in two countries can be daunting. Yet, with the right knowledge, you can turn potential pitfalls into opportunities. This guide demystifies the complexities of […]

Facing the tax challenges in the arts and entertainment industry can often seem as complex as the roles played by its members. At Ross Professional Corporation, we specialize in turning these challenges into tax opportunities for financial clarity and success. Whether you’re a new artist on the scene or a veteran behind the camera, our […]

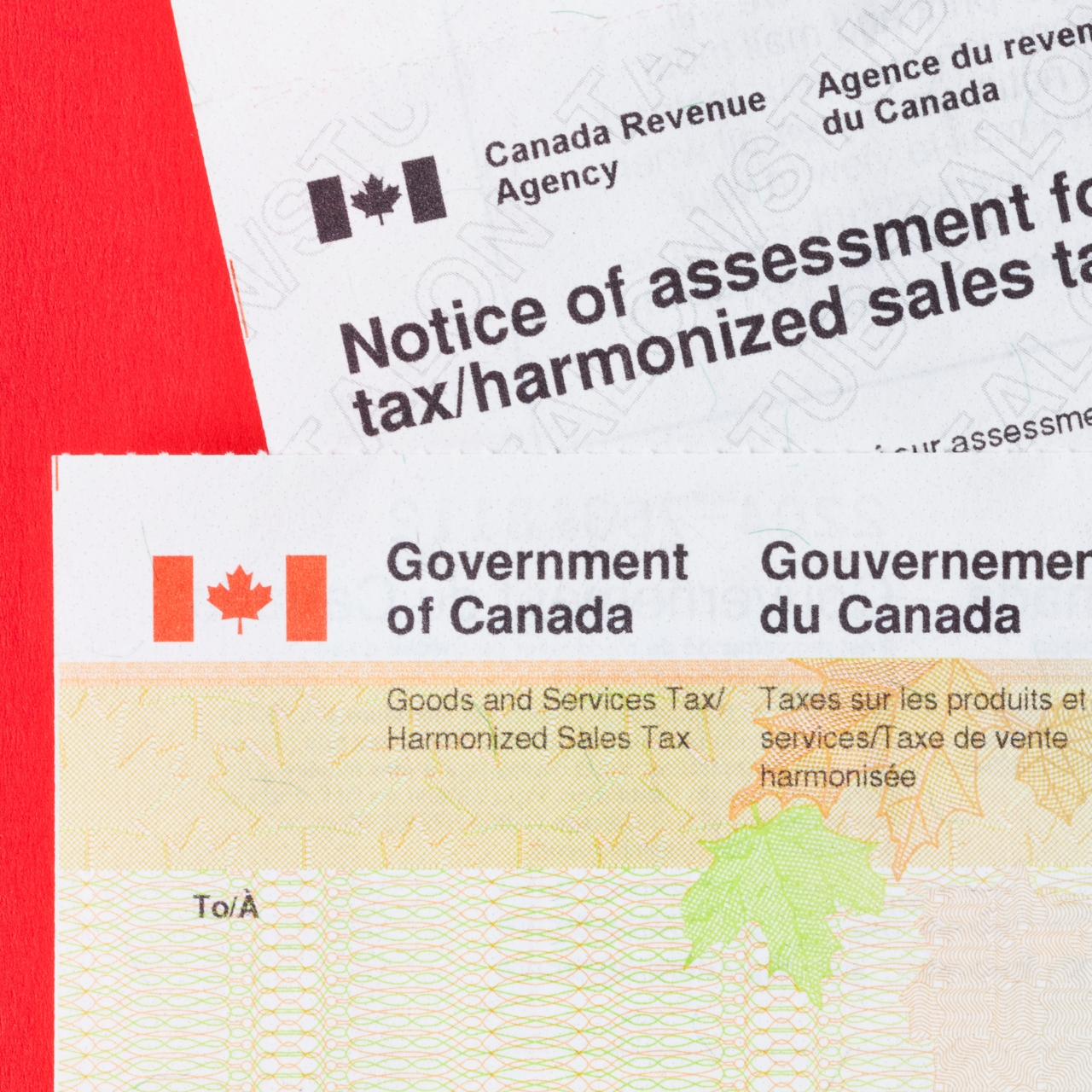

As the new year rolls in, it’s the perfect time to start preparing for tax season. This guide offers valuable insights and practical advice to navigate the complexities of tax filing, specifically focusing on Canadian tax regulations like GST/HST and harmonized taxes. Whether you’re an individual or a business owner, these tips will help you […]